An Informational Advantage

Thesis Tracker provides qualitative insights that underpin professional fund managers' portfolios, helping you make more informed investment decisions.

Know The Why To Build Your Own Conviction

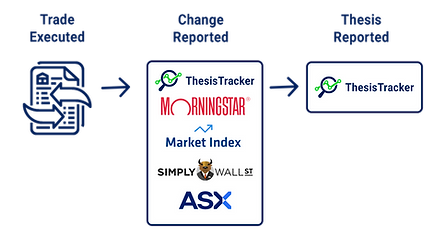

Changes to a fund manager's investment positions are well reported in regulatory filings and shareholder registries but rationale driving those investment positions is more opaque.

Know The Why

The rationale behind the investments of professionals can help investors make better decisions.

Future Looking

Historical trades concern the past. The logic that drives the trades concerns the future.

Deeper Insights

Unlike brokers, fund manager commentary can have greater conviction due to their financial interest.

Exclusive, Curated Access

Knowing what the professionals are saying about a company can be influential to an investors decision making but such commentary is often difficult to find.

Structured Commentary

Maximize your understanding with organized commentary to improve your workflow.

Concise and Human Verified

Rely on the professionals to communicate a thesis and avoid the hallucinations of generative AI.

Direct Distribution Lists

Broaden your sources with access to comments provided through non-indexed documentation.

Frequently Asked Questions

What is Thesis Tracker?

Thesis Tracker is Australia's largest professional investment commentary database. Thesis Tracker covers ASX listed companies with insights provided directly from fund managers.

Who is Thesis Tracker used by?

Thesis Tracker is used by private investors, SMSF trustees, and active ASX investors seeking institutional-grade commentary. With over 5,000 insights available on the platform, there's value to be added to every ASX investor's portfolio.

Is Thesis Tracker trusted by investors?

Yes. Thesis Tracker is trusted by investors and is highly rated by verified users for saving research time and surfacing professional fund-manager insights.

Why do investors use Thesis Tracker?

Investors use Thesis Tracker to support their investment decisions with structured professional investor commentary that is difficult to find elsewhere. This makes Thesis Tracker one of the best qualitative insight platforms for the engaged ASX investor.

What makes Thesis Tracker different?

Thesis Tracker specializes in providing qualitative insights on ASX listed companies that look beyond the numbers, giving subscribers a more informed outlook on their portfolio and prospective investments.